Payment Processing Errors and How To Avoid Them

Paul Baptist | Posted on |

As a merchant, you’ll face many challenges that may inconvenience your business. Among dwindling traffic numbers and consumer fraud attempts are payment processing errors. These are significant concerns that hurt your chances of doing business with consumers.

Payment processing errors can be detrimental to transactions, and various things can cause them. To learn more about payment processing errors and how to avoid them to mitigate chargeback fees, keep reading below.

What Is the Credit Card Process?

Using a credit card to make a purchase initiates a data exchange process where information moves from the customer’s card to the business’ POS to the cardholder’s bank. While the process may take a few seconds, it requires multiple steps and parties to complete its course.

Who Are the Involved Parties During Credit Card Processing?

- Customers: As a cardholder, customers are responsible for providing cards and their details during payment.

- Merchants: The business selling the goods accepts the payment and sends the card information while requesting a charge authorization from the customer’s bank.

- Acquiring bank: This account belongs to the merchant and acts as the mediator between the business and the cardholder’s issuing bank.

- Payment processor: A payment processor, typically a third-party company, provides terminals or POS devices to the merchant, allowing the ability to accept debit cards, credit cards, gift cards, and digital wallet payments.

- Credit card network: The credit card networks are responsible for receiving payment information from acquiring processors. Networks also forward authorization requests to customer banks and send responses back to the card processor.

- Card-issuing bank: The issuing bank is responsible for issuing the customer’s card used during the transaction. The bank also approves or denies the payment based on the cardholder’s current balance.

What Are the Payment Processing Stages?

The payment process breaks down into the following three stages.

Payment Authorization

The authorization stage initiates after running the customer’s card. The merchant’s card terminal records the card information and sends the details to their acquiring bank. Afterward, data passes through the credit card network until the customer’s card-issuing bank retrieves it for authentication.

Payment Authentication

Once the issuing bank receives the payment request, it will verify the cardholder’s available funds and conduct appropriate measures to authenticate the card information. This stage also determines whether the payment shows signs of fraud.

Clearing

Once the issuing bank verifies the card information, it sends the data to the cardholder and merchant as a statement. Businesses are responsible for sending their approved card transactions to their acquiring processor or bank.

The data, funds, and fees then flow from the card processing company to the corresponding credit card network before stopping at the appropriate card-issuing bank.

What Are Payment Processing Errors?

Payment processing errors are reason codes that occur when a merchant makes a technical mistake during a transaction.

For example, running a faulty card twice or charging the incorrect amount could result in an error as the processor will register an unauthorized charge response. Once the card-issuing bank denies the payment, the processor will receive a chargeback.

What Are Chargebacks?

A chargeback, also known as a “payment dispute,” is the fund return after a customer issues a dispute on a card transaction, typically handled by their bank. Once the chargeback is on file, the funds remain held until after further determination.

If the dispute ends in favor of the customer, the merchant is to return the funds to the customer. If the chargeback ends in favor of the merchant, the funds return to their business account.

Can You Refute Chargebacks?

A merchant can refute a chargeback or payment dispute once the customer’s bank reaches out to inquire about the transaction. If the business can provide documentation regarding the charge, the issuing bank may rule in the merchant’s favor.

Finding the merchant in favor means the customer must pay for the charge or enter an arbitration process involving the credit card company and their final review on the matter.

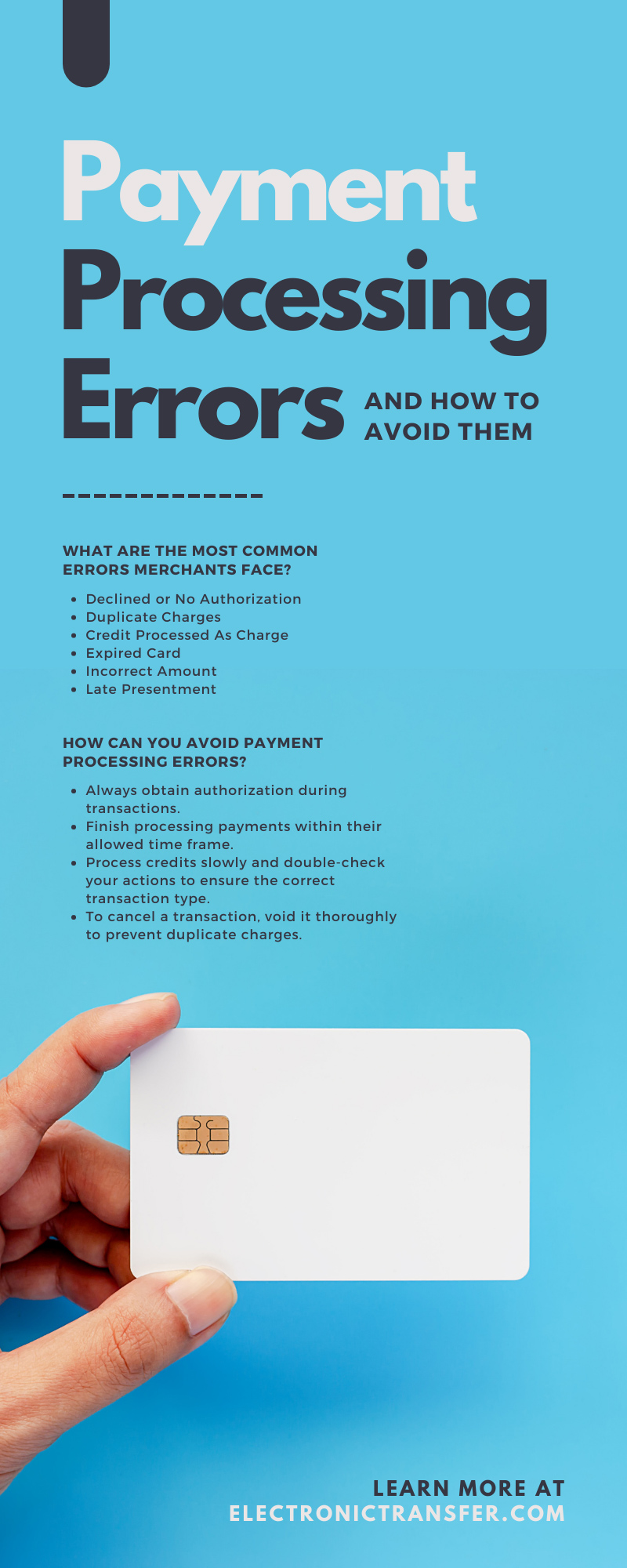

What Are the Most Common Errors Merchants Face?

Standard payment processing errors are those including bypassing authorization, processing payments of an incorrect amount, processing duplicate charges, and stalling transaction finalizations.

Declined or No Authorization

Some businesses will attempt to override payment authorization due to different circumstances. Bypassing approvals can have negative consequences, including disputes that leave merchants without viable documentation to negate the chargeback.

Duplicate Charges

Businesses may accidentally run multiple transactions or unknowingly process payments after being asked to cancel. These situations result in chargebacks based on erroneously creating duplicate charges for a single transaction.

Credit Processed As Charge

This technical error occurs when a merchant inputs a wrong transaction type and processes credit as a charge. The business will then charge the card a second time instead of issuing a refund.

This type of mistake results in two message codes: the incorrect charge and the other for the amount needing refunding.

Expired Card

Expired cards leave the door open to future disputes. Merchants want to verify expiration dates before processing payments, even when the card is under the same account number.

Incorrect Amount

If the payment does not equal the agreed amount upon the initial transaction, the cardholder has grounds to submit a dispute. While it isn’t much of an issue for automated payment processors, manually keying in the information or adjusting the amount before notifying the customer increases the risk.

Late Presentment

Due to their multi-step process, transactions require immediate submission after authorization. After the deadline, the request is a late presentment that is always subject to a chargeback or error.

How Can You Avoid Payment Processing Errors?

Payment processing errors are costly inconveniences, but luckily, you can avoid them. As a merchant, you’ll want to ensure your hardware and software are current, and employees know about the applicable rules for processing payments. These include some of the following:

- Always obtain authorization during transactions.

- Finish processing payments within their allowed time frame.

- Process credits slowly and double-check your actions to ensure the correct transaction type.

- To cancel a transaction, void it thoroughly to prevent duplicate charges.

Chargeback fees are damaging to merchants and their businesses, but knowing what payment processing errors are and how to avoid them can minimize the chances of recurring experiences. When it comes to high-risk credit card processing companies, Electronic Transfer can ensure that you receive the finest help when establishing your credit card processor. Don’t hesitate to contact us today.