How To Get Approved for a Business Line of Credit

Paul Baptist | Posted on |

If you own a startup, chances are you’re aware of the need for capital to help with expansion. Small businesses are no stranger to late invoices, unplanned expenses, and other situations that can affect cash flow.

In these cases, it would help to have extra funds to help you survive through uncertain times. A business line of credit can be beneficial when trying to access needed capital.

Here’s how to get approved for a business line of credit.

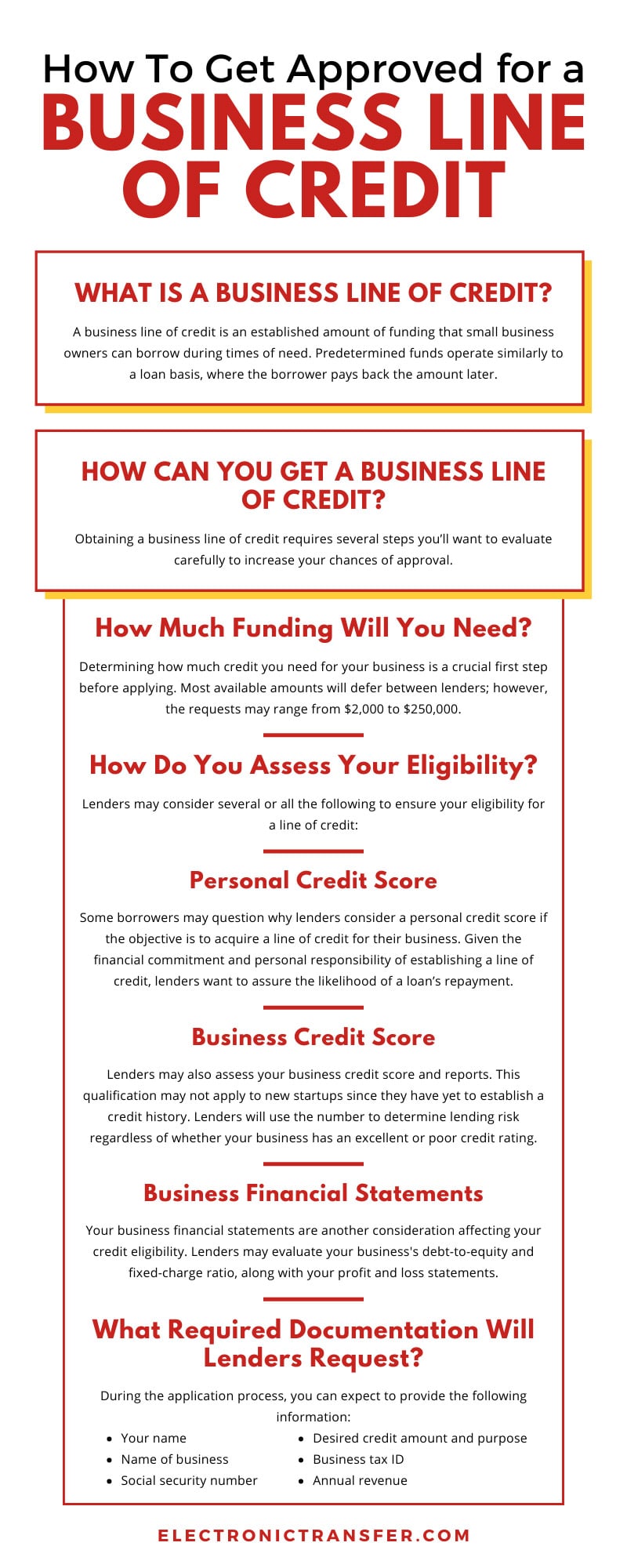

What Is a Business Line of Credit?

A business line of credit is an established amount of funding that small business owners can borrow during times of need. Predetermined funds operate similarly to a loan basis, where the borrower pays back the amount later.

Are There Different Types of Lines of Credit?

You’ll notice two types of lines of credit: unsecured and secured business lines.

Secured Business Line of Credit

Secured business lines of credit guarantee access to funding through collateral, such as a home or vehicle. Putting up collateral against the credit assures your lender that in the event of failed payments, they can seize your assets to cover the owed balance.

Unsecured Business Line of Credit

Unsecured lines of credit do not require you to put up assets against the line. However, most lenders classify unsecured lines of credit as higher risk requests, so you can expect the credit to accrue interest at a higher rate than a secured option.

Given their risk, unsecured lines also hold the borrower to higher qualifications to obtain approval.

How Does a Business Line of Credit Differ From a Loan?

While sharing several overlapping qualities, business lines of credit have notable differences from a business loan, mainly in how a borrower would access their approved funds.

How Does a Small Business Loan Work?

Typically, a business loan will present you with a one-time lump sum of funds. The goal behind taking out a business loan is usually for a specific purpose and comes with fixed payment terms.

Most business loans feature higher interest rates on the total amount of funding, whereas a line of credit will accrue interest on the amount used.

How Does the Line of Credit Work?

To gain a deeper understanding of using a business line of credit, imagine obtaining approval for $75,000. You may allocate $25,000 for facility renovations and begin paying it back to the lender. A few months later, you may borrow $15,000 during a slower business period.

Regardless of the amount, funding will be available as long as you pay back the credit borrowed at the time. This would make the line of credit useful for many years without closing upon repayment.

How Can You Get a Business Line of Credit?

Obtaining a business line of credit requires several steps you’ll want to evaluate carefully to increase your chances of approval.

How Much Funding Will You Need?

Determining how much credit you need for your business is a crucial first step before applying. Most available amounts will defer between lenders; however, the requests may range from $2,000 to $250,000.

Due to the line’s flexible interest rate, it’s acceptable for a higher amount as long as you don’t pass your spending threshold. If you wish to have access to more funding, consider requesting a credit line increase. Conversely, your lender may approve your request or require you to put up collateral to secure the line.

How Do You Assess Your Eligibility?

Lenders may consider several or all the following to ensure your eligibility for a line of credit:

Personal Credit Score

Some borrowers may question why lenders consider a personal credit score if the objective is to acquire a line of credit for their business. Given the financial commitment and personal responsibility of establishing a line of credit, lenders want to assure the likelihood of a loan’s repayment.

You can expect a lender to conduct a credit check, so it would be wise to have a good credit score. Conversely, obtaining a business line of credit with a lower score is possible, but it increases the possibility of a higher interest rate.

Business Credit Score

Lenders may also assess your business credit score and reports. This qualification may not apply to new startups since they have yet to establish a credit history.

Lenders will use the number to determine lending risk regardless of whether your business has an excellent or poor credit rating.

Business Financial Statements

Your business financial statements are another consideration affecting your credit eligibility. Lenders may evaluate your business’s debt-to-equity and fixed-charge ratio, along with your profit and loss statements.

A lender may also consider your debt service coverage ratio, which gives them an insight into your operating income and current liabilities.

Time in Business

Most banks will require businesses to be in operation for at least one or two years when applying for credit. Since smaller companies have a higher failure rate, banks can be more cautious in lending credit, therefore asking for more supporting documentation.

Time in business requirements can differ between lenders, but in most cases, newer businesses may have difficulty securing a low-cost line of credit.

Annual Revenue

Lenders may scrutinize a borrower’s annual revenue and income. While the requirements may differ between banks, online lenders may ask for a minimum of $50,000 of generated revenue. On the other hand, traditional banks typically ask for a minimum of $100,000.

A business with substantial revenue demonstrates your reliability in paying back your business line of credit.

Industry

Unfortunately, some businesses are riskier to operate than others, resulting in banks proceeding cautiously when lending credit. It would help to have experience in your selected industry before opening your company to increase your chances of approval.

For those higher-risk companies, Electronic Transfer can assist you in your ventures. We are high-risk merchant account providers that offer services at competitive rates.

What Required Documentation Will Lenders Request?

During the application process, you can expect to provide the following information:

-

- Your name

-

- Name of business

-

- Social security number

-

- Desired credit amount and purpose

-

- Business tax ID

-

- Annual revenue

Required documentation needed to support your request may include the following:

-

- Personal and business tax returns

-

- Business license

-

- Personal and business tax statements

-

- Profit and loss statements

-

- Financial statements

-

- Business plans

-

- Lease

Knowing how to get approved for a business line of credit increases your chances of securing funding when handling financial challenges. Once you evaluate your eligibility and gather your documents, you can access a flexible financial product that ensures the success of your business.